Tailored Employee Benefit Solutions

We help create supportive, employee-focused workplaces to attract and retain the best talent through engaging, effective workplace wellbeing.

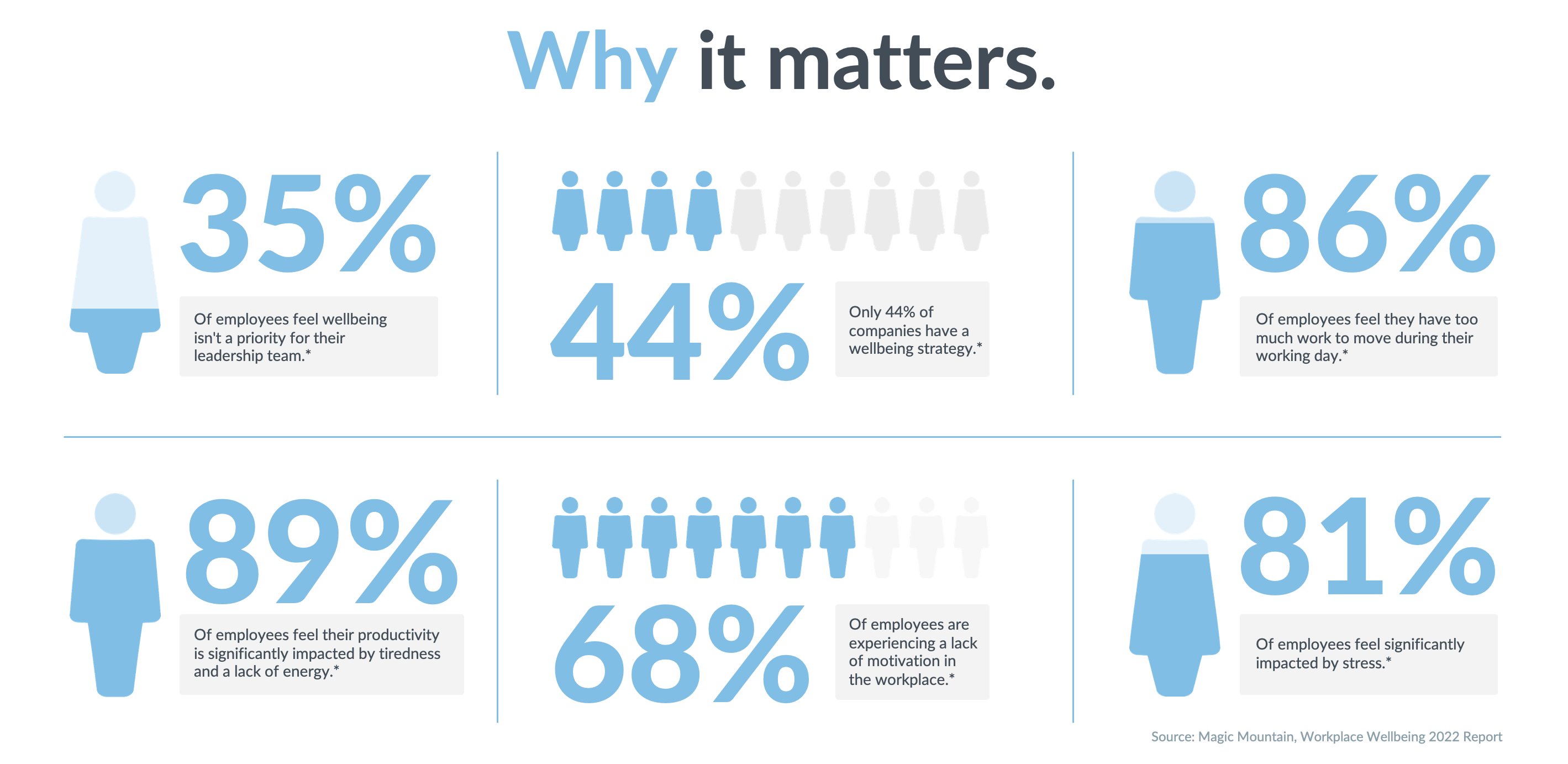

Health and Wellbeing has never been higher up the agenda for individuals and businesses.

Your Journey. Our Services.

Real-life results

You’ll Love Us Too.

“Jim and the team have always been superb to deal with and have brought considerable benefit to us in securing services and solutions which support the wellbeing of our colleagues”

Henderson Group, Belfast

“We have been working with our relationship manager, Kelly Connolly for a long time and we find her very knowledgeable, responsive and works with us as a partner to guide us though any situation as it arises, removing complexities”

BearingPoint, London

“The Incorporate team have been extremely helpful with our healthcare policies and are very helpful and prompt in responding to queries.”

Almac Group, Portadown

“Clodagh always gives us sound advice and has become a real trusted advisor for our organisation. We can always rely on her to be responsive and explain benefits in simple, everyday terms with no jargon.”

Alchemy, Londonderry